- Excuse Me SIR. ICYMI 🦄

- Posts

- ICYMI 🦄 From Grief to Growth, The New It Girls of Investing, What Money, Markets & Misogynists Got Wrong This Week.

ICYMI 🦄 From Grief to Growth, The New It Girls of Investing, What Money, Markets & Misogynists Got Wrong This Week.

The only Startup & Investor Newsletter you need to become smarter in 15 Mins or Less Each Week

Issue Highlights

THIS WEEKS MANTRAS

This season has been one of shedding, of saying goodbye to the comforts I once built my life around: the structures, the clients, the travels, the stability I thought I needed. For a long time, those comforts kept me safe, but they also kept me from growing. And when I wouldn’t listen, life kept whispering, “this is no longer for you,” until it finally forced me to let go.

So here I am: grieving what’s gone, yes, but also making peace with the slowness of rebuilding. The pace feels quiet, almost like a whisper but slow is still moving. Every ending is creating space for what’s next. And every opportunity, every platform, every connection I step into from here will be built with more intention, more alignment, more courage.

This isn’t an ending. It’s a shedding. And in that release, I find both relief and hope.

We are still here. We are still moving. And that alone is proof of our resilience.

Mantras for this week:

Slow is still moving.

What leaves creates space for what’s next.

Not an ending, just a shedding.

Source @pinterest

🤍 EXCUSE ME SIR.™ PODCAST 🤍

This week I sat down to chat about the importance of when & why to say no to opportunities because as female founders, we’re taught to say “yes” to every opportunity, every connection, every idea. But the truth? Saying “no” is the most profitable move you’ll ever make.

In this episode, I break down how to evaluate opportunities like a true strategic operator:

• The 3 types of leverage every founder should measure decisions against (people, cash, and multipliers)

• Why the best operators obsess over what they don’t do

• How to put a dollar value on your time using your target exit valuation

• A simple rule to instantly decide if something is worth your energy or a distraction

If you’re scaling toward $10M, $30M, or even $50M…learning to say “no” might be the single biggest unlock for your revenue, valuation, and peace of mind.

💸MONEY MOVES - YOUR 30 MIN EXIT AUDIT 💸

Open Up a Google Doc or Grab your Journal…

1. Grab your top 10 customer

2. Revenue by product

3. Churn for the last 12 months.

Can a stranger understand your growth engine in 2 pages? If not, tighten:

1. One-page Revenue Map

2. One-page Unit Economics.

Future-you (and future-buyer) says thanks.

🎀 Are Agencies the New Consumer Darling? 🎀

(Why “services” might be the next big asset class everyone slept on)

For the Last Decade, Consumer Brands were the Prom Queens of Private Equity & M&A ( Case In Point Poppi & Rhodes BILLION Dollar Acquisitions ). But while beauty brands were running off Sephora shelves, Agencies were treated like the “Plain Best Friend” Useful…Yes, but never the star. These industries are Historically underfunded, dismissed as “unscalable,” by Institutional investors & potential acquirers boxed in as “hours for dollars” kinda businesses.

But 2025 is giving us a plot twist…services, especially creative and marketing agencies are stepping into main character energy. Investors are swiping right, holding companies are circling, and the math is starting to work in their favour.

Why? Because the best of these firms don’t look like “hours for dollars” anymore.

They look like platforms. ( Historically Fundable, Scalable, Transferable Models )

If Glossier could raise millions on shelf velocity, agencies can now raise on NRR. Different runway, same investor logic.

What’s Changed ie. The Rebrand of Services…

It’s not that agencies suddenly discovered they’re cute, It’s that the market shifted around them. After a quiet two years, deal flow in marketing and agency services climbed again in 2024 (Davidson Capital Advisors, Capstone Partners both note rising appetite for “platform-style” shops.) And Whilst the market still is not where we want to see it, buyers are bounding back slowly but surely. In fact, PE investment into agency services jumped 21% YoY in 2024 (SI Global).

The shops getting attention today aren’t Mad Men-era “let’s make a campaign” “Let me manage your socials” boutiques. They’re performance machines ie. agencies with outcome-tied contracts, proprietary data, recurring retainers, and IP that feels closer to a product than a pitch deck.

If a consumer brand’s beauty is in its shelf velocity, an agency’s new beauty is in its attribution dashboard.

Here’s the investor fantasy:

If you want capital, your agency has to look like an asset. That means scoring high on:

Recurring revenue (retainers, managed services)

Measurable attribution (contracted outcomes, rev-share)

Specialization (depth, not generalist sprawl)

IP/Data (formats, tech, proprietary benchmarks)

Scalable delivery (productized offers, nearshore leverage)

Low client concentration (<20% top client)

Margins + growth (18–25% EBITDA, 15–30% YoY growth)

Roll-up logic (is your shop a tuck-in platform?)

Hit 5–6 and you stop looking like “billable hours.” You start looking like a platform. And platform logic gets funded.

If you need proof this isn’t theoretical, just look at the way creators and celebrities are quietly rewriting the playbook. Ryan Reynolds’ Maximum Effort blurred the lines between Hollywood and Madison Avenue—pairing creative IP with owned distribution and performance TV tech (MNTN). That’s not an “agency,” it’s an ecosystem.

The formula works because attention is the most expensive line item on every P&L. If you own it, package it, and tie it to performance, you don’t just pitch campaigns…you build compounding assets.

Why this matters…

If you’re running a service firm right now, this is your moment to stop apologizing for not being “product-based” and start leaning into what actually makes you fundable. The playbook is straightforward but not optional:

Lock in 40–60% of revenue on recurring contracts.

Codify your IP, frameworks, formats, data, or tech.

Standardize attribution so clients (and investors) see outcomes.

Specialise, then scale.

Line up 1–2 tuck-in targets so you can tell a roll-up story.

And then Aim for a Roll up Because the Roll-Up Game is Well & Truly on. Accenture Song, Publicis, Omnicom, Are still bolting on boutique Agencies to round out CX, commerce, and creative stacks. Droga5 inside Accenture is the case study.

Do that, and you stop looking like “a bunch of creatives with Slack” and start looking like a platform with an exit multiple.

Sooooo Are Agencies the New Consumer Brands? ( How to Compare )….

Consumer brands still map neatly to 5–7 year PE theses (brand, velocity, distribution, gross margin → clear EV path).

Service platforms can now match that if they show: sticky ARR/retainers, NRR >100%, attributable lift, and accretive M&A potential (synergies on SG&A, cross-sell).

The “service shop” era is re-opening. Only now, the shops that get funded look less like freelancers with a logo, and more like mini-platforms with productized IP, sticky ARR, and roll-up logic baked in.

The market is finally catching up to what service founders have known all along: creativity scales when it’s packaged, measured, and owned. The same way consumer brands had their golden window in the 2010s, services are entering their investable era now.

Because in 2025, agencies aren’t just selling hours. They’re selling assets.

SIR. Cool Girl Finance Glossary™

PE (Private Equity): Big-money firms that buy companies like they’re handbags, hold for a few years, flip for more.

M&A: Fancy talk for buying and selling companies. Basically, corporate dating → marriage → divorce → remarriage.

Institutional Investors: Big, professional investors like pension funds, banks, or private equity firms (vs. individual angels).

Hours for Dollars: Old-school agency model: trading your time for cash. Cute for freelancers, not fundable.

Shelf Velocity: How fast a product flies off the shelf. Investor code for “this brand is hot.”

NRR (Net Revenue Retention): How much $$$ your current clients keep spending on you each year. Over 100% means your clients spend more with you year after year.

Deal Flow: How many buy/sell/Investment opportunities are floating around in the market. Think of it as the “dating pool” for investors.

Performance-Based: Getting paid for results (sales, conversions) not just effort or hours logged.

Retainer Revenue: Monthly subscription for your services. Steady, predictable, and investor catnip.

Attribution: Proving exactly which campaign brought the money in. AKA receipts.

Client Concentration Risk: When too much of your income comes from one client, if they leave, so does your rent money.

EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization is simply a measure of operating profit. Think of it as “true” profitability before financial/technical adjustments.

YoY Growth: Comparing your glow-up from this year to last year.

Roll-Up: Buying smaller firms to build one big baddie of a company.

Exit Multiple: How much someone will pay for your biz, usually X times your profit.

Owned Distribution: Channels you actually control (email list, your app, loyal following) vs. paying Zuckerberg rent for ads.

Synergies: Corporate speak for “1+1 = 3.” Cutting overlaps or cross-selling to make more money together.

ARR (Annual Recurring Revenue): The yearly subscription money that shows up like clockwork.

🤍 Briefings They Don’t Want You To Hear that the SIR.™ Boardroom has been Gossiping About all Week 🤍

What Is Moving both the Market & Us

E.L.F Joins the Rage Bait Marketing Trend & is losing major fan point after collaborating with known Misogynistic Comedian Matt Rife HERE.

Healthcare & Drugs Taking the D2C Route? See what Barrons has to say about it HERE.

Will Services Industries & Agencies become the New Equivalent of “Consumer Darlings” To investors?? Pharrell Launches New Creative Label “Virginia” HERE. But so do Kendrick Lamar & Dave Free….Could they be onto something? HERE.

I wish I could have said I told you so….but I won’t HAHHAHAH I have been preaching this for a few months but Private Credit is the Invest App You should all be keeping an eye on and speaking to your Investment Advisors About! HERE.

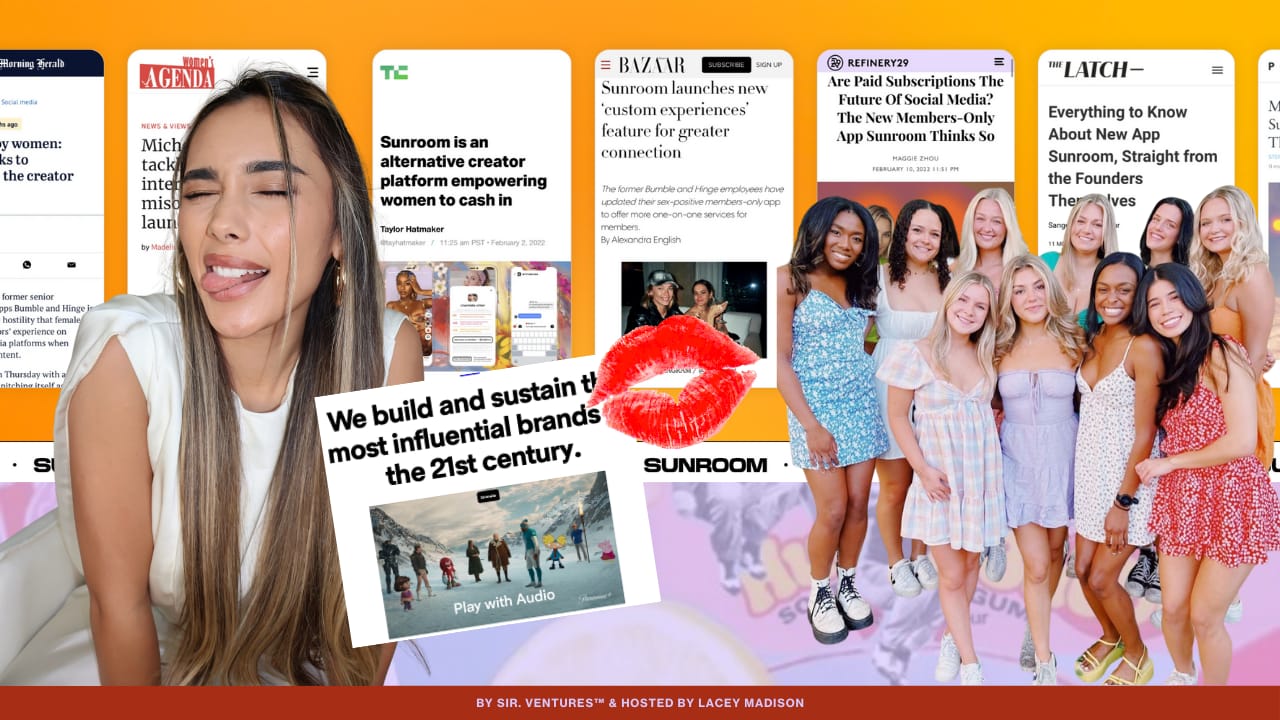

Kosas joining a long list of Consumer Brands Realising Sororities are the true influencers & that there is HUGE Untapped Market Potential HERE.

Anyone can blow Up on Social Media, But True Celebrity Status is achieved when the Tabloids & Traditional Media Start Paying Attention Too…HERE.

That is all for this Week!!

xox, Lace

SIR. VENTURES

Strategic operators, capital architects, and scaling partners for SMEs in the $850K–$5M range, helping them scale into transferable, capital-attractive companies, ready for exit, investment, or aggressive market expansion. HERE.

SIR. BUSINESS ACADEMY™

Invitation-only boardroom for female founders scaling past $1.5M–$5M and into enterprise-level growth. It is a peer-powered space where women navigate the Big 3 of time, team, and capital together, with access to strategic experts, curated panels, and the collective intelligence of fellow high-growth CEOs. HERE.

VENTURA™

Sell-side exit readiness firm that transforms small and mid-sized companies into buyer-ready assets. We handle the heavy lift, from cleaning up finances and operations to preparing the data room and positioning for maximum valuation so founders can go to market confident, organised, and in control. HERE.

Reply